Prefer to Listen? Play this quick summary instead!

If you have been injured in a motor vehicle accident, it is common to feel unsure about what a CTP claim covers. Many people expect their green slip to work like general insurance. That misunderstanding often leads to frustration and delayed decisions. Compulsory third-party or CTP insurance pays for recovery, not for damage to vehicles or property.

In simple terms, what CTP insurance pays for is treatment, care, and support linked to injury. Coverage focuses on helping people recover function, return to daily activities, and regain independence. It does not exist to repair cars, replace belongings, or cover unrelated expenses.

Quick takeaway: CTP supports people injured in a motor vehicle accident. It does not cover damage to your car or property.

What Is a CTP (Green Slip) Claim?

A CTP (Green Slip) claim is a compulsory insurance claim that supports people injured in a motor vehicle accident. In Australia, the CTP insurance’s meaning is simple. It exists to help injured people recover. It does not insure vehicles or property. Understanding this distinction early prevents confusion and unrealistic expectations.

What CTP Is Designed to Do

A green slip claim in Australia is a framework that focuses on injury-related needs. It covers reasonable and necessary treatment linked to the crash. It may also support care needs and, in some cases, income if work capacity is affected. The aim is recovery and function, not compensation for loss or inconvenience.

What CTP Is Not

CTP is not vehicle insurance. It does not pay for car repairs, towing, or property damage. It is also not automatic or unlimited. Entitlements depend on injury, medical evidence, and insurer approval. Payments follow rules, timeframes, and thresholds set by state legislation.

What CTP Insurance Covers and Does Not Cover

| CTP Covers | CTP Does Not Cover |

|---|---|

| Injury-related treatment | Car repairs |

| Care and support | Property damage |

| Some income loss | Non-injury expenses |

What CTP Usually Pays For

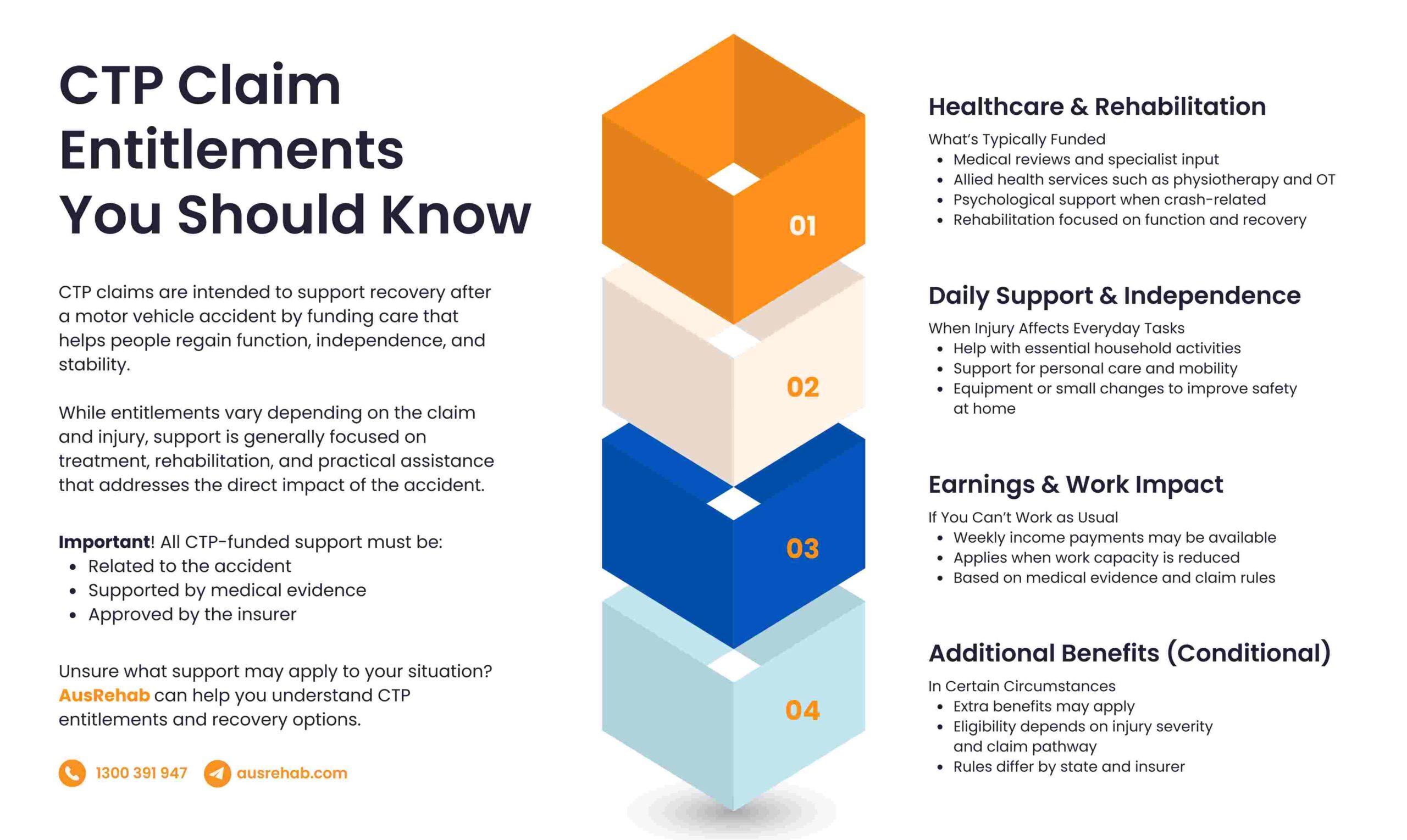

Understanding CTP claim entitlements helps injured people plan recovery with fewer surprises. In most cases, CTP medical expenses covered relate directly to treatment and rehabilitation needs arising from the accident. Payments focus on care that supports function, independence, and safe return to daily activities.

Treatment and Medical Care

CTP commonly covers reasonable medical treatment linked to the injury. This includes general practitioner (GP) and physiotherapy visits, as well as specialist appointments required for diagnosis, monitoring, and recovery.

Does CTP cover physiotherapy and occupational therapy (OT)? In approved cases, physiotherapy and occupational therapy are covered to address movement, strength, daily tasks, and functional goals. Psychology or counselling may also be supported when emotional or psychological symptoms are related to the crash and form part of recovery.

Rehabilitation support sits within this category. These services focus on restoring function, improving confidence, and reducing long-term impact. Treatment plans are tailored to the injury and reviewed over time to ensure they remain appropriate.

All treatment must be directly related to the motor vehicle accident and approved by the insurer. CTP does not fund care that is unrelated, excessive, or outside agreed-upon guidelines. Clear medical evidence and timely communication help keep treatment moving without delays.

Does CTP cover medical treatment like physio or OT?

Yes. CTP commonly covers physiotherapy, occupational therapy, and other approved rehabilitation services when they are related to injuries from the accident and supported by medical evidence.

Care and Support Needs

Beyond medical treatment, CTP care and support services can assist when injuries affect everyday function. This support focuses on practical help rather than comfort or convenience. Domestic assistance may be approved when tasks like cleaning or meal preparation are difficult due to injury. Support with activities of daily living (ADL) under CTP, such as showering, dressing, or basic mobility, may also be covered when clinically justified.

In some cases, equipment or minor modifications are approved to improve safety and independence at home. Each support must relate directly to the injury and be considered reasonable and necessary.

Does CTP pay for psychology or counselling?

CTP can cover psychology or counselling when emotional or psychological symptoms are linked to the accident and treatment is approved by the insurer.

Income Support (If Work Is Affected)

CTP income support payments may apply when an injury reduces earning capacity. Payments are usually made weekly and are based on pre-injury earnings and medical certification. Support only applies when work capacity is genuinely affected by the accident. Time limits and step-down rules often apply, so payments are not open-ended. Ongoing eligibility depends on medical evidence and claim pathway requirements.

Does CTP cover income loss if I can’t work?

CTP may provide weekly income payments if your earning capacity is reduced due to accident-related injuries. Payments are subject to eligibility rules, medical certification, and time limits.

Other Payments (Limited Situations)

Some claims include additional CTP payments, though these are more limited and depend on injury severity and claim type. Entitlements vary by state and insurer, with different rules for benefits beyond treatment, care, and income support. Because these payments are tightly regulated, check official guidance through SIRA services in NSW or through the insurer to confirm what may apply in your situation.

What does a CTP claim actually pay for?

A CTP claim usually pays for medical treatment, rehabilitation, care and support needs, and limited income support if work capacity is affected. All support must be injury-related and approved by the insurer.

What CTP Does Not Pay For

Understanding what CTP does not cover is just as important as knowing what it does. Many disputes and delays come from assumptions about entitlements that sit outside the purpose of a CTP claim. CTP is designed to support recovery after injury. It is not a general insurance product for accident-related costs.

Common Misunderstandings

CTP does not pay for car repairs or towing. These costs fall under comprehensive or property damage insurance. Property damage of any kind sits outside the CTP scope. This includes damage to vehicles, fences, or personal items.

CTP also excludes costs that are not linked to an injury. Expenses must be directly related to treatment, care, or functional impact from the accident. Convenience costs or lifestyle expenses are not covered.

Another frequent misunderstanding involves duration. CTP does not provide unlimited or ongoing payments. All benefits are time-limited and subject to approval, medical evidence, and claim pathway rules. Payments can change or end as recovery progresses.

💡 Did You Know? A common misconception is that your green slip pays to fix your car. It does not. Vehicle repairs are covered by comprehensive or property insurance, not CTP.

Key Timeframes You Should Know

Understanding CTP claim time limits in NSW helps avoid missed entitlements and unnecessary stress. Timeframes affect how claims are assessed and how payments are applied. Delays can limit options even when an injury is genuine.

Why Lodging Early Matters

Lodging a CTP claim early supports continuity of care and income assessment. In NSW, submitting a claim within 28 days can affect whether income payments are backdated. Delays may reduce or remove access to certain benefits, even when treatment is approved later.

Early lodgement also helps insurers assess the claim while the information is fresh. Medical evidence, accident details, and functional impact are easier to confirm when timelines are clear. This can reduce disputes and administrative delays.

Although broader deadlines often apply, waiting creates risk. Each state has its own rules, thresholds, and claim pathways. Missing an early window does not always end a claim, but it can change what is payable and from when.

💡 CTP timeframes vary by state and insurer. Always confirm current requirements with your insurer or the relevant state authority before relying on general guidance. Knowing when to lodge a CTP claim gives you more control and fewer surprises during recovery.

How long do CTP payments last?

CTP payments are time-limited and depend on injury severity, recovery progress, and claim pathway. Payments do not continue indefinitely and are reviewed over time.

What You’ll Usually Need to Keep Things Moving

Having the right documents needed for a CTP claim helps your insurer assess treatment, care, and payments without delays. Missing or incomplete information often slows approvals and follow-ups. Clear records support continuity of care and reduce back-and-forth requests.

Commonly Required Information

Use this checklist to stay organised and keep your claim progressing:

✅ Accident details: Date, location, vehicles involved, and police reference if applicable.

✅ Medical evidence: Certificates, reports, and notes linking treatment to the accident.

✅ Referrals and reports: From GPs and treating providers who support ongoing care.

✅ Proof of income: Payslips, tax records, or employer confirmation if work is affected.

✅ Receipts and invoices: For treatment, travel, equipment, or approved supports.

✅ Summary of daily impact: Short notes on sleep, mobility, driving, and daily activities.

Providing a clear picture early helps insurers understand the need and approve support sooner. Keep copies of everything you submit and note dates of contact. If you are unsure what applies to your situation, confirm requirements with your insurer to avoid delays.

Common Mistakes That Can Slow a CTP Claim

Many delays come from common CTP claim mistakes that are easy to avoid. Small gaps in information can pause approvals and extend timelines. Clear, early action keeps recovery support moving.

What to Avoid

❌ Assuming car repairs are covered. CTP supports people, not vehicles. Repairs fall under other insurance.

❌ Lodging late. Delays can affect back pay and early entitlements. Submit as soon as possible.

❌ Not mentioning all symptoms early. Even mild issues matter. Early disclosure supports appropriate care.

❌ Missing receipts. Unsubmitted invoices slow reimbursement and approvals.

❌ Incomplete treating provider documentation. Reports must link treatment to the accident and outline the need.

Avoiding these pitfalls helps insurers assess your claim efficiently. Keep records organised, share changes promptly, and confirm requirements with your insurer if unsure. Clear communication early reduces hold-ups later.

How AusRehab Can Support Recovery Under CTP

Recovery under CTP focuses on function, safety, and independence. AusRehab supports this process with practical, OT-led guidance that aligns care with insurer requirements and real-world needs. Support stays centred on what you can do now and what helps you progress safely.

Supporting Function and Independence

Everyday tasks matter. ADL support under CTP looks at how injury affects cooking, personal care, mobility, and routines. Assessments identify barriers and practical steps that restore independence without overloading recovery.

Addressing Driving Concerns

Driving is often a key concern after a crash. OT driving assessment CTP reviews readiness, attention, confidence, and safety. Where needed, driving rehabilitation programs rebuild skills gradually. Ergonomic advice improves seating, controls, and comfort to reduce strain and fatigue.

Coordinated Care

Clear communication keeps claims moving. AusRehab liaises with GPs, insurers, and case managers to align goals, share functional insights, and provide guidance when capacity changes. This coordination supports timely decisions and consistent care.

Common CTP Recovery Needs and How AusRehab Support Helps

| Need | How Support Helps |

|---|---|

| Daily tasks | Activities of Daily Living (ADL) assistance |

| Driving safety | Occupational Therapy (OT) assessment |

| Confidence | Graded rehabilitation |

| Documentation | Clear reporting |

Speak With a Specialist About Your CTP Claim Entitlements Today

Recovering after a car accident can feel uncertain, especially when it comes to understanding what a CTP claim actually supports. Making informed decisions early can reduce delays and stress. Clear documentation, early lodgement, and an understanding of what support is available all help keep recovery moving forward.

If you are unsure how your CTP claim applies to recovery, daily living support after a car accident, or OT-led rehabilitation, help is available. You can also check out our video to learn more about CTP claim support after a car accident.

Frequently Asked Questions (FAQs)

What is a CTP (green slip) claim?

A CTP claim is a compulsory insurance claim that supports people injured in a motor vehicle accident. It helps cover injury-related treatment, care, and, in some cases, income support. It does not cover vehicle or property damage.

Does CTP pay for car repairs or property damage?

No. CTP does not cover car repairs, towing, or property damage. These costs are handled through comprehensive insurance or property damage claims, not the green slip.

When should I lodge a CTP claim?

You should lodge a CTP claim as soon as possible after the accident. Early lodgement helps avoid delays and may affect eligibility for backdated income payments, especially in NSW.

What documents are needed for a CTP claim?

Most CTP claims require accident details, medical certificates, treatment reports, proof of income, receipts, and information about how injuries affect daily activities and work.

How can AusRehab support recovery under CTP?

AusRehab supports recovery by focusing on function and independence. This may include ADL support, OT driving assessments, rehabilitation planning, and clear reporting to insurers and treating doctors.